[00] See It In Action

See how it works in 2 minutes

Watch a quick walkthrough of FractalCycles — from searching a symbol to detecting statistically validated cycles and identifying potential turning points.

[01] Core Capabilities

Everything you need for cycle analysis

Spectrum Analysis

Identify dominant cycle periods in your data with high precision across all timeframes.

Statistical Validation

Rigorous testing validates cycle significance. Only trust patterns that pass our validation.

Regime Detection

Trend persistence analysis reveals whether your market is trending, mean-reverting, or random.

Nest of Lows

Detect when multiple cycles trough together, indicating potential cycle convergence zones.

[02] Your Edge

A Research Advantage By Design

Every feature is engineered to enhance your market analysis with rigorous methodology.

Advanced Engine

Our algorithm processes millions of data points to deliver unparalleled cycle detection accuracy.

Data-Driven Insights

Cut through market noise with data-driven insights that identify potential cycle turning points.

Flexible Plans

Start free, then scale as you grow. Choose the plan that fits your research style and analysis needs.

Bring Your Own Data

Cannot find your instrument? Upload your own dataset and let our engine work its magic.

Real-Time Analysis

Keep your analysis current with live cycle detection that updates as new market data becomes available.

Institutional Grade

Access the same caliber of technology used by top hedge funds and trading firms around the world.

[03] The Difference

The Institutional Edge

You Have Been Missing

While retail traders struggle with lagging indicators and guesswork, institutions have been using advanced cycle analysis to identify recurring market patterns with precision.

The Old Way

- Lagging Indicators: Relying on outdated tools that only show you where the market has been, not the underlying patterns driving it.

- Emotional Decisions: Guessing market direction based on hope, fear, and hype, leading to inconsistent results.

- Incomplete Picture: Missing the underlying market cycles that drive major trends and reversals.

The FractalCycles Way

- Pattern Analysis: Utilize advanced cycle detection to identify recurring market patterns based on historical data.

- Data-Driven Precision: Make decisions with confidence, backed by statistically validated signals.

- Total Clarity: See the complete market picture and understand the forces driving price action.

[04] How It Works

From raw data to actionable insights

Upload your market data, let our algorithms detect hidden cycles, validate them statistically, and identify potential turning points. All in a few clicks.

Upload or fetch data

CSV import or live data from major exchanges

Detect cycles automatically

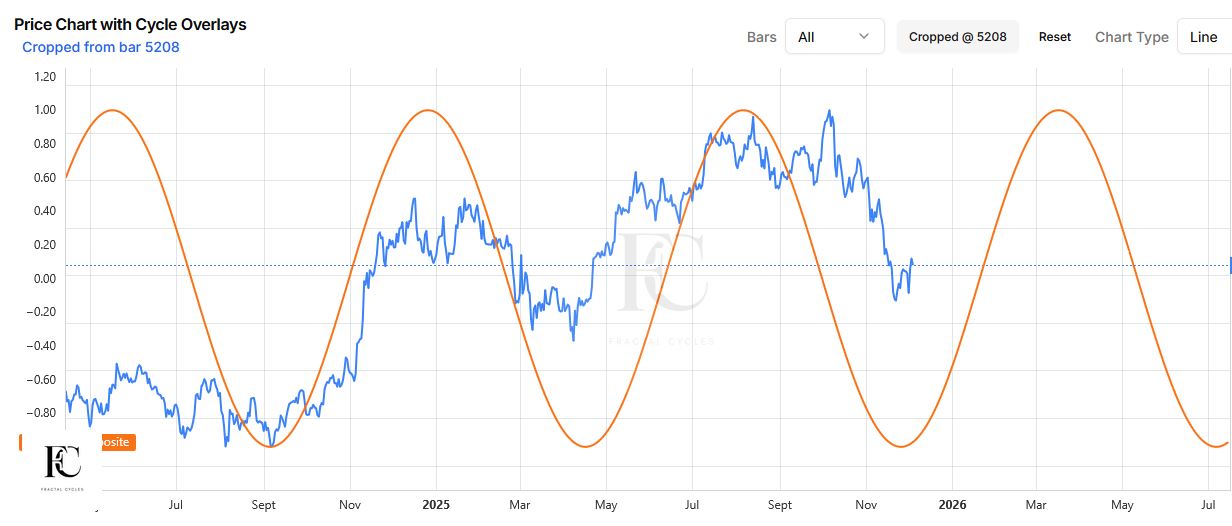

Advanced spectrum analysis finds hidden patterns

Identify turning points

Combine cycles to recognize potential reversal zones

1000+

Analyses run

50+

Markets supported

99.9%

Uptime

Free

Tier available